Grade 12 Accounting is not just about making the Balance Sheet balance. In fact, you can get a distinction even if your Balance Sheet doesn’t balance. The secret lies in understanding the International Financial Reporting Standards (IFRS) and mastering the art of analysis.

The exam is split into two papers. Paper 1 is about financial reporting to the public (Shareholders), while Paper 2 is about internal management (Factory and Costing). Here is how to master both.

Paper 1: Financial Reporting & Evaluation (150 Marks)

This paper focuses on the “Big Picture” of a company’s finances.

1. Statement of Comprehensive Income (Income Statement)

You must be able to prepare this from a Trial Balance and a list of adjustments.

- The “Adjustments” Trap: The marks are not in the final profit figure; they are in the brackets. You need to master:

- Depreciation: Know the difference between “Cost Price” method and “Diminishing Balance” method.

- Rent Income: Watch out for “Rent received in advance.” You must subtract the extra month to strictly reflect the 12-month period (Matching Principle).

- Tax: Always calculate the correct income tax (SARS) based on the Net Profit before tax.

2. Statement of Financial Position (Balance Sheet)

- The Golden Rule:

\text{Assets} = \text{Equity} + \text{Liabilities}

- Retained Income Note: This is often tested separately. Remember:

- Start with Balance at beginning of year.

- Add: Net Profit after tax.

- Subtract: Dividends (Interim + Final).

- Subtract: Share Buybacks (the amount above average share price).

3. Cash Flow Statement

This is a guaranteed question. You need to separate cash into three buckets:

- Operating Activities: Cash generated from daily trading. Tip: Depreciation is added back here because it is a non-cash expense.

- Investing Activities: Buying/Selling Fixed Assets.

- Financing Activities: Loans, Shares, and Dividends. Tip: If you pay back a loan, it is an outflow (bracketed).

4. Analysis and Interpretation (The Distinction Section)

This is where the distinction marks are. You need to calculate ratios and comment on them.

- Solvency: \text{Total Assets} : \text{Total Liabilities}. (Can the company pay off all debts if it closes today?)

- Liquidity: Current Ratio and Acid-Test Ratio. (Can the company pay short-term debts?)

- Return: ROSHE (Return on Shareholders’ Equity). Always compare this to the interest rate on alternative investments (like a fixed deposit).

Paper 2: Managerial Accounting & Internal Control (150 Marks)

This paper focuses on the internal running of a business.

1. Manufacturing (Cost Accounting)

You are calculating the cost of making a product (e.g., a chair).

- Direct vs. Indirect Costs:

- Direct: Wood and the Carpenter’s wages (Prime Cost).

- Indirect: Factory Rent and Electricity (Factory Overheads).

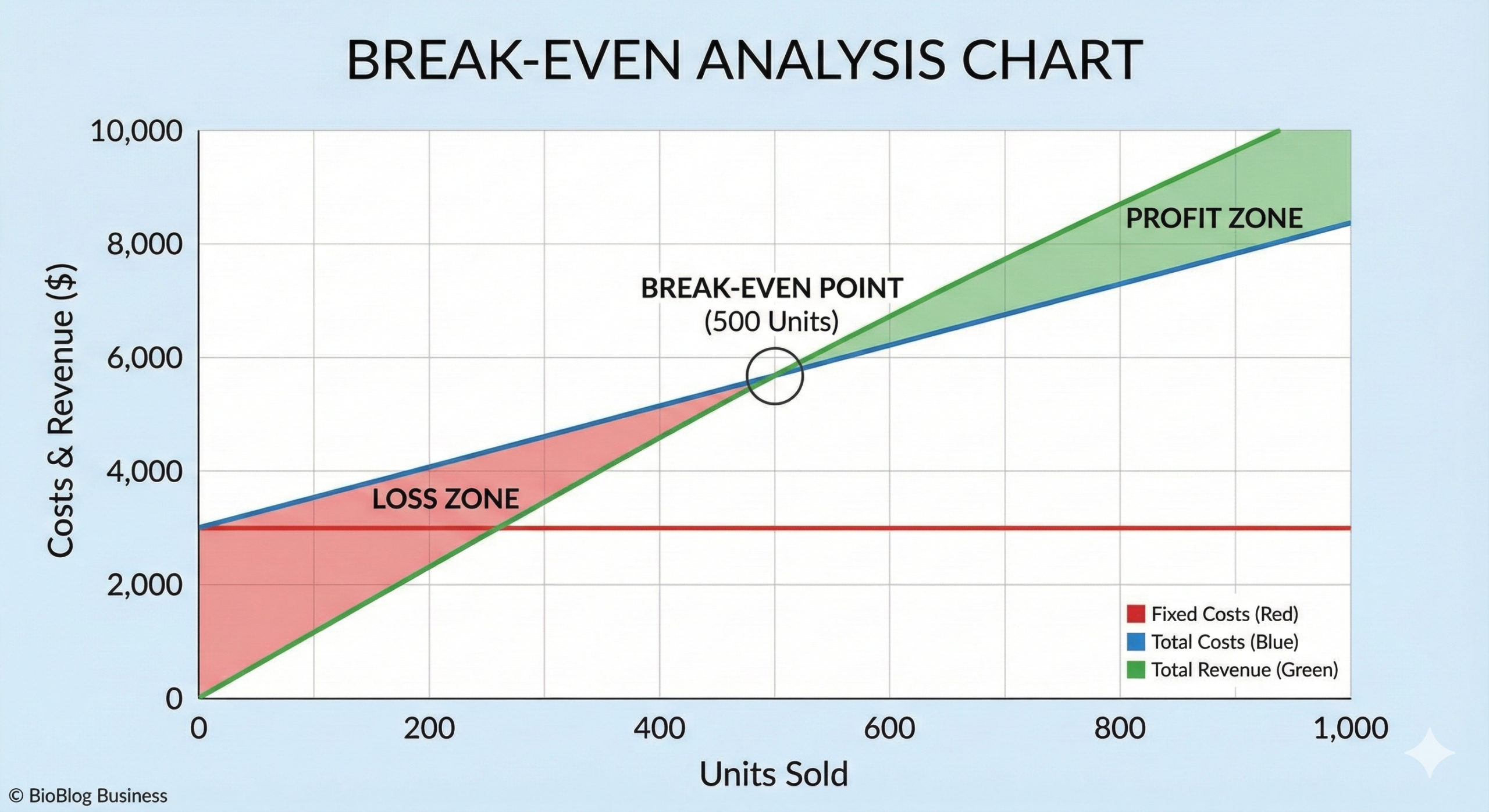

- Break-Even Point: This is the magic number where you make neither a profit nor a loss.

\text{Break-Even Point} = \frac{\text{Total Fixed Costs}}{\text{Selling Price per Unit} - \text{Variable Cost per Unit}}

- Exam Question: “Should the company import raw materials for cheaper?” You must discuss the effect on the Break-Even point and the quality of the product.

2. VAT (Value Added Tax)

- Calculations: You must be able to calculate VAT output, input, and the amount payable/refundable to SARS.

- Concepts: Know the difference between:

- Zero-rated items: Basic foods (Brown bread, milk, maize). The seller charges 0% but can claim input VAT.

- Exempt items: Services (Transport, Education). The seller charges no VAT and cannot claim input VAT.

3. Reconciliations

You act as a detective to find errors.

- Bank Reconciliation: Compare the Bank Statement (External) with the Cash Journals (Internal).

- Creditors Reconciliation: If the Creditor says we owe R10,000 but our ledger says R8,000, find the missing invoice or discount.

4. Inventory Valuation

Prices go up over time (Inflation). How do we value our unsold stock?

- FIFO (First-In-First-Out): Assumes we sell the old stock first. In times of inflation, this results in a higher value of closing stock and higher profit.

- Weighted Average: We calculate an average price per unit. Used for identical items like petrol or grain.

Decksh’s Top 3 Tips for a Distinction

Tip 1: Master the “Comment” Structure

Many students fail because they just say “The ratio is good.” You need a structure:

- Quote the figures: “The Current Ratio increased from 1.5:1 to 2.4:1.”

- Compare: “This is above the industry norm of 2:1.”

- Conclude: “Therefore, the company’s liquidity has improved, but they may be holding too much idle cash.”

Tip 2: Don’t “Balance” the Balance Sheet

This sounds crazy, but it is true.

- If your Balance Sheet doesn’t balance, DO NOT spend 20 minutes looking for the error.

- You only lose 1 or 2 marks for the final total being wrong.

- If you waste time looking for the error, you will miss the next question, which is worth 20 marks. Move on.

Tip 3: Ethics and Corporate Governance

You will be given a scenario (e.g., “The CEO hired his brother’s construction company”).

- You need to identify the ethical principle broken (Conflict of Interest).

- Use the King Code principles: Transparency, Accountability, Fairness, and Responsibility.

Conclusion

Accounting requires accuracy and logic. Treat every adjustment like a puzzle piece. If you master the Cash Flow Statement and the Ratio Analysis, you are well on your way to a distinction.

Good luck with your Matric Finals!